Does Civil Service Pension Increase With Inflation

This web page contains general information well-nigh civil service pensions.

Delight note that I cannot answer questions most private pension entitlements. Possible sources of advice are listed in Notation 4 below.

Fundamental Facts

Civil service pensions were one time thought to be very generous, simply the civil service alimony scheme is now broadly similar to the better private sector schemes. As a result, those few ceremonious servants who earn generous salaries practise retire with equally generous pensions. Only the vast majority of civil servants are not particularly well paid and they retire with pensions that are also far from generous.

1 peculiarly generous element - for a minority of staff, and unremarkably the more senior staff - was that pensions used to be calculated by reference to final salary. So those who who had been promoted several times, particularly tardily in their career, gained substantial benefits from this rule. But the old final salary pension scheme was closed to new entrants from July 2007. From that date, new entrants joined a career boilerplate scheme - see below for an explanation of what this means. The Authorities has likewise moved pre-July 2007 members to a new career average scheme from 2012 - but for futurity accruals only, and only for those more than 10 years from Normal Retirement Age.

Another generous element was the almanac uprating past reference to the Retail Prices Index (RPI). But incoming Chancellor George Osborne announced in June 2010 that civil service pensions would in hereafter increase each year in line with the Consumer Prices Index (CPI) not RPI) This immediately reduced the value of all scheme benefits - including those benefits already accrued from by contributions - by around xv%. (A comparison of historic RPI and CPI shows that if this dominion had practical in the by then the pension of someone who had retired in 1988 would by 2010 have been 15% lower than it was. Run across notes 2 and 3 for further data nearly the differences between CPI and RPI.)

A third apparently generous chemical element was that civil servants did not announced to contribute to the cost of their pensions. Only this was in fact much less generous than information technology seemed every bit salaries were and so prepare at lower levels, every bit though pension contributions had indeed been deducted. Chancellor Osborne yet as well announced in 2010 that he believed that the price, to the taxpayer, of public sector pensions needed to be reduced, and the most effective way to brand short-term savings was to increase member contributions. The Chancellor announced that the disbelieve rate used to estimate the future return on current pension contributions should be reduced, so requiring college contributions - 'though partly from employers. The Chancellor said that he chose the rate at which the economy is expected to abound which he took to be iii%. If that was indeed his logic, and so 3% seemed pretty optimistic, and he reduced the rate further to 2.eight% in the 2016 Budget, although the resultant increase in pension contributions was this time taken merely from employers.

On the other manus, the Government announced in November 2013 that all public sector pensions would go on to increment afterward retirement in line with aggrandizement (as measured by the CPI) for at least the side by side 25 years. This is not ever the case for private sector pensions.

Finally, ceremonious service pensions, similar several other UK public sector pensions, are 'pay as yous become' (or unfunded). At that place is no pension (investment) fund. Pensions are instead funded by contributions from current employers and employees, topped upwards every bit necessary by the Treasury. This arrangement is often criticised as existence in some manner unfairly advantaged when compared with funded schemes. But it probably makes sense, given the size of the scheme, not least because of the administrative and other costs that would be needed to create and manage the fund.

The post-2012 alimony scheme accordingly has the following features:

- Benefits already accrued under previous schemes will be protected. In particular, those who entered the civil service before July 2007 volition have the proportion of their pension that is accrued up to April 2012 calculated by reference to the salary they are on when they eventually retire.

- Pensions will be uprated each yr by reference to CPI, not RPI.

- Alimony contributions accept increased - in part equally a result of the 'burden sharing' summarised below - but with further increases on peak. The higher paid have had their contributions increased by upwardly to nearly 5% more than the lower paid. The average increase was iii.2%.

- The 'normal pension age' for civil servants retiring in the adjacent few years is now 67, and information technology volition somewhen rise to 68, alongside similar changes to the age that older people can start to receive the the state alimony.

As a result ...

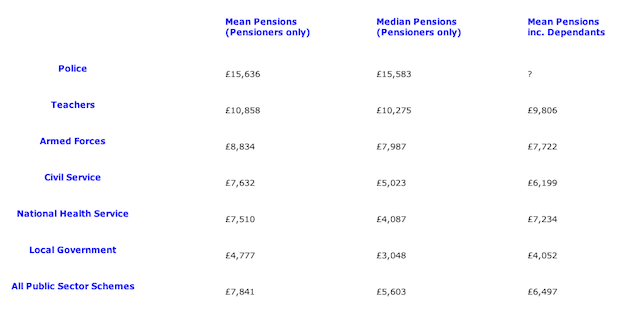

Nigh ceremonious service pensions are hardly excessive, although some 'high-fliers' who entered before career averaging was introduced in July 2007 exercise much amend than nigh. The following table (extracted from Hutton'southward acting report - see Annotation three) summarises all public sector pensions in payment in 2009-ten. See also the notes at the terminate of this web-page for data nigh the differences between the public sector pensions paid to men and women.

(Hateful figures, below, are total pensions divided by number of pensioners. The median is the figure above (and below) which half of pensions may be found. Hateful is much college than median where at that place is a relatively small number of high paid staff - and hence high pensions - with a long 'tail' of depression paid staff, and hence lower pensions. There are effectually 300 public service pension schemes, merely more than than 95 per cent of members are in the six largest categories of scheme - local government, NHS, teachers, civil service, armed forces and police force.)

Table 1

Background

In that location are big problems with both public and private sector pension schemes throughout the adult earth, as people live longer and nascence rates autumn. In the Britain, life expectancy at nascency is increasing at an astonishing i year every four years. It is estimated that the ratio of UK pensioners to workers will therefore increase from 27% in 2004 to 48% in 2050 - unless something changes. The inevitable consequence is that employers and/or their employees now demand to set aside a much college proportion of salaries to meet pension costs, or else employees accept to retire much later, or a combination of both. Precipitous falls in share prices around the beginning of this century added to the pressure on funded "terminal salary" schemes and so caused attending to be fatigued to the special circumstances of the unfunded civil service pension scheme.

The problem for the Government is that many civil servants regard their pension equally a hugely important part of their overall remuneration package. Senior Civil Servants, in detail, are paid essentially less than their private sector counterparts, and become none of their perks, such as company cars and private health insurance. Their pension really does matter to them. So the Authorities was faced with a large pension cost, and a workforce determined non to have their employment contract re-written. But it nonetheless imposed the changes summarised in a higher place.

Historical Groundwork

Pensions were introduced by employers - in detail in the military machine and then the ceremonious service - in society to facilitate the retirement of older less efficient workers so as to make way for younger fitter men. The very beingness of such schemes then encouraged employers to recruit younger fitter people who would work for many years before drawing their pensions.

The showtime pensions appeared in the late 1600s in the public sector. Earlier so, information technology was the custom for serving naval, Customs officers etc. to sell their office for a lump sum or annuity. The first known civil service pension was awarded in 1684 when a senior Port of London official became too ill to carry on, and his successor was appointed on a salary of £80pa on condition that £40pa of this was paid to his predecessor. And and so began the commencement l% pension, paid out of the bacon of a younger employee.

Significant further developments occurred in the 1760s and 70s when contributions and pensions were extended to junior officers in the armed services etc., and once again in the 1847 when the Admiralty decided to face the fact that 200 senior captains were never going to sea again, promoted them to Rear Admiral, and put them on half pay as a form of retirement pension. Soon later on, in the 1850s, Northcote and Trevelyan recommended that "adept service pensions" should be extended into "the ordinary Civil branch of the public service" (Northcote Trevelyan Study - see in particular pp 21-22). A Royal Commission reporting shortly after Northcote & Trevelyan then separately recommended that retirement from the ceremonious service should be possible at age 60 and compulsory at historic period 65. In that location were parallel developments in the individual sector, equally railway, gas and other large companies developed similar schemes to concenter and retain amend staff.

A more detailed history of occupational pensions may exist found in chapter 12 of Pat Thane'south "Sometime Age in English History".

Those interested in more item will find information technology in a 2021 National Audit Office report on public service pensions (summary here) as well as on this web page.

Notes

1. Male person public service pensioners typically receive more than female person pensioners. Hutton noted that the median male public sector pensioner receives only over £8,000 per annum, while the median female person pensioner receives just under £4,000 per annum. This gap can be explained in part by a combination of more fragmented female careers (especially continued to caring responsibilities), differential rates of role-time employment (in that location are currently more than seven times as many female part-time public service workers every bit male ones) and historic differences in careers and consequently in pensionable pay. More data about the issues facing women ceremonious servants can be found here.

two. This ONS Consultation Document explains why CPI is by and large lower than RPI. This is non (as has ofttimes been reported) because one uses geometric averaging and ane uses arithmetical averaging. The real reasons are much more complex and include the manner in which clothing prices are tracked, and the fact that the RPI (unlike the CPI) includes housing costs but excludes purchases more often made by low and high income households.

This - from John Kay - neatly explains why there is no one 'correct' measure of inflation:

The stock market place goes upwards and down. Suppose its level alternates each year between 50 and 100, with no upward or down trend. What is the capital return on the market? Common sense suggests the answer is zero. Simply is that mutual sense right? In the good years yous obtain a return of 100 per cent. In the bad, the yield is minus l per cent. The boilerplate render is therefore 25 per cent. There is logic to that. If you invested the same corporeality every twelvemonth, and sold at the cease of a year, you would indeed make - on average - a very attractive return of 25 per cent a yr. What if you bought and sold at random? In that example, 4 options are equally likely: buy and sell at 50, buy and sell at 100, purchase at l and sell at 100, purchase at 100 and sell at 50. The overall annual expected gain is 12.5 per cent.

If y'all are past now thoroughly confused, you are not alone. The average celebrated render on the volatile equity market is central to calculations of the cost of uppercase and provision for time to come pension liabilities. But the effigy has been debated for decades. The dispute is less most the underlying data than about the way yous brand the calculation. The question is often framed as the choice between arithmetic and geometric means. But there is no correct or wrong reply. In all problems of this kind, the relevant measure is specific to the particular purpose y'all have in listen.

In do, of course, regime continues to use RPI when it suits it - for increasing excise duties for example.

It remains to be seen whether CPIH will in time supervene upon CPI. It is, from early 2017, ONS' preferred measure of full general aggrandizement.

3. The 2011 Hutton Report provides a good summary of the issues surrounding public sector pensions.

4. Those looking for more detailed information, including about their own pensions, should try one or more of these options:

- contact the Human Resources department of their previous employer,

- bank check out the principal Civil Service pensions website or phone 0300 123 6666 (+44 1903 835 902 from overseas)

- contact the Ceremonious Service Retirement Fellowship - a registered charity that is defended to helping sometime civil servants, their partners, widows/widowers and dependants make the nigh of their retirement.

- contact the Pensions Tracing Service

- contact the Civil Service Pensioners Alliance

5. This is a complex subject and I would be glad to exist corrected if I have misunderstood or over-simplified anything. But please note that I cannot answer questions near the civil service pension scheme or individual pension entitlements, nor can I assist trace pensions. You should instead use the resources listed in Note 4 higher up.

6. The Regal Institute of Public Assistants published a report on public sector pensions in the 1960s.

Martin Stanley

Spotted something incorrect?

Delight do driblet me an email if you spot annihilation that is out-of-date, or whatever other errors, typos or faulty links.

Does Civil Service Pension Increase With Inflation,

Source: https://www.civilservant.org.uk/information-pensions.html

Posted by: emersonfaccul.blogspot.com

0 Response to "Does Civil Service Pension Increase With Inflation"

Post a Comment